Why are defense stocks going up?

Amidst geopolitical tensions in the recent month defense stock like Cochin shipyard, GRSE and Zen Technologies are going up against all odds, let’s see possible reasons behind it.

Local demand

Due to recent cross border tensions between India and Pakistan has raised the local demand for defense equipment even more.

Geopolitical tensions fueling the needs of defense equipment.

The Ukraine Russia war is not seeming to stop anytime soon, together with middle eastern tension pushes export potential of the munitions and other electronic equipment.

Government policies

Industry friendly policies like Defense Acquisition Procedure 2020 and Positive Indigenization List increases ease of doing business and boost local manufacturing.

Budget allotment

India’s defense budget is increasing at an constant rate, from 1.9 lakh crore Rupees in 2012 to 6.8 lakh crore it has tripled in 12 year and projected to be increased to 31.7 crore in the year 2047.

NATO increasing defense budget

US President Donald Trump in the beginning of his second term urged all NATO members to increase their defense budget to at least 5% of GDP which is more than double their current defense budget of 2%. NATO secretary has already confirmed boosting their defense spending.

Stocks to look for

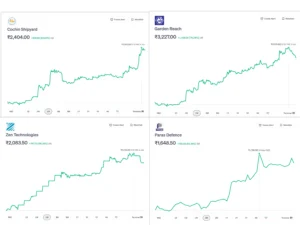

- Cochin Shipyard Ltd

Cochin shipyard is a leading company in India’s ship building and ship repair industry. It has jumped up almost 20% in the last week. It has almost doubled it’s share price in the last two months, currently trading at Rs. 2421.

- Garden Reach Shipbuilders and Engineers Ltd.

GRSE is another Govt. of India undertaking company leading shipbuilding and repairing. In the months it has shown a tremendous share price growth rate of almost 86% reaching it’s all time high of Rs. 3425.

- Zen Technologies

Zen Technologies manufactures various defense electronic system and other equipments such as Anti Drone Systems, Combat Training Centers, Multi Channel Phased Array Digital Module, Smart Targeting Systems etc. The share price has showed a 60% surge from 1361INR to 2191INR in the past month.

- Paras Defence and Space Technologies Ltd

Paras Defense is another leading company in the space and defense sector. The company has showed a significant surge of almost 29% in its share price in the last month. The company has also shown tremendous growth potential, its profit margin has also seen a significant jump of almost 50% in the last quarter.

- Mazagon Dock Shipbuilders Ltd

Mazagon Dock Shipbuilders Ltd is another Govt. of India undertaking company that manufacture both war-ships and shipping vessels. In the last, company share price has increased 15%, and a even better 40% increase in the last 6 months.

The recent regional conflicts and the rising geopolitical tensions has given significant boost to the defense manufacturing industries. Some other stocks worth looking are Mishra Dhatu Nigam, BEML Ltd, Bharat dynamics , Data patterns (India) Ltd, etc. Although stocks like Bharat Electronics Ltd(BEL), Hindustan Aeronautic Ltd(HAL) has minor declines due to supply chain concerns, the share prices are projected to increase significantly in the long run.