What is Market Coupling?

Market Coupling is a way to connect different markets is different regions of the country so the balance between supply and price can be created. In terms of electricity, Market Coupling is a way to connect electricity markets in different regions or countries so that power can flow where it’s needed most — at the best price.

Lets understand with a simple analogy-

Lets assume 3 fish markets-

– Price of the fish per kg in Mumbai is 100 rupees.

– Price of the fish per kg in Delhi is 150 rupees.

– Price of the fish per kg is Bangalore is 80 rupees.

Without market coupling, people in Delhi have to buy at ₹150.

But with market coupling, traders can see all prices and buy from the cheapest city, say Bangalore (₹80), and send to Delhi. This balances supply and price.

In Electricity

Electricity prices in India differ across regions due to supply, demand, and grid constraints. Market coupling uses specific algorithms to automatically match buyers and sellers across regions. It ensures electricity flows from low-price regions to high-price regions — using available transmission capacity which result in uniform prices, better use of infrastructure, and cheaper power overall.

How it affects IEX?

Recently India is planning to implement market coupling via the Central Market Coupling (CMC) mechanism — where one platform determines price and volume for all power exchanges (like IEX, PXIL) to remove inefficiencies and avoid price wars. What does this means for IEX?

India currently has multiple power exchanges like IEX, PXIL and HPX, each of these runs separate auctions which results in different prices for the same day. Market coupling will change this in a way-

– Common pricing for all the exchanges.

– A common algorithm, to match bids and allocate trades.

– Fair distribution of trades for all exchanges based on demand and supply.

Some of the benefits are that the market becomes transparent and efficient, the market is less prone to price manipulation.

But it does comes with a few major risks for IEX , like it loses the pricing power, a potential decline in volumes in trades due to migrations of the users over to other exchanges, etc.

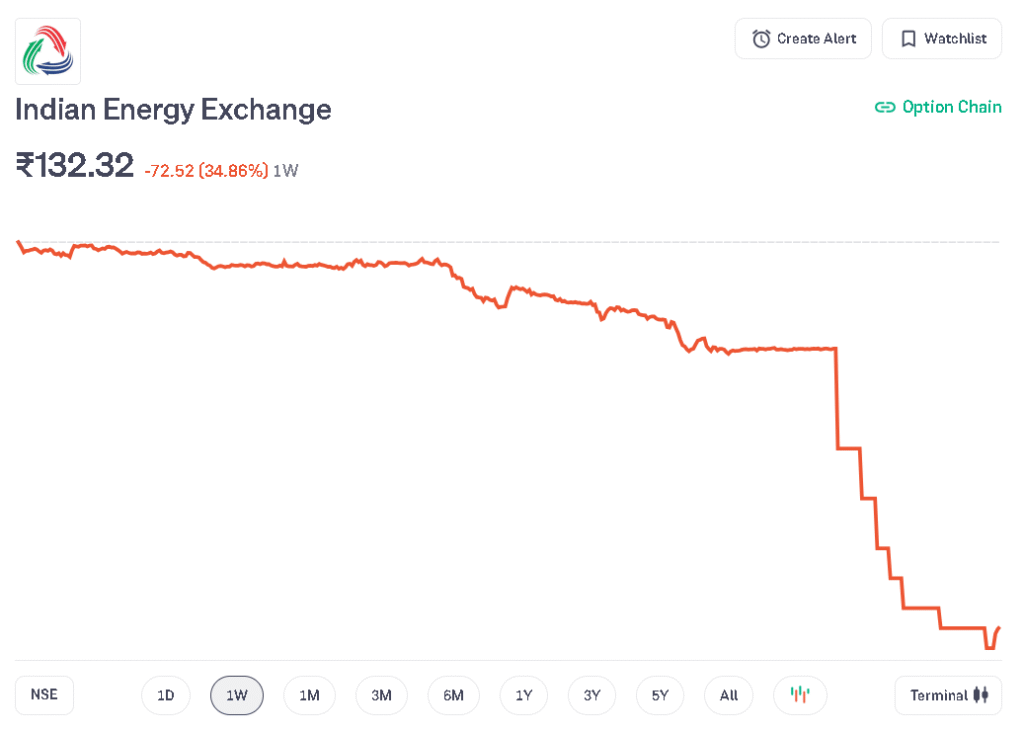

The market reacted vigorously to this and the share price of IEX crashed nearly 25%, it is currently trading at around INR 132.